Contactless & EMV Chips Cards

At this time we have both Contactless and EMV Chip Cards in circulation. While we've had EMV Chip Cards for some years now, we began issuing Contactless debit cards in early 2024.

What's a Contactless debit card and how does it work?

A contactless card uses radio frequency identification (RFID) technology and near-filed communication (NFC) to process transactions. They have a small embedded chip that eliminates the need to swipe or insert your card. This chip creates a one-time code for each transaction and it's this code that's transmitted when you pay. Your name, billing address, and card verification code aren't transmitted, making contactless cards safer to use.

How do I use a Contactless chip card?

- Look - Check for the Contactless Symbol on the merchant's checkout terminal.

- Tap - When prompted, bring your card within a few inches of the Contactless Symbol on the terminal.

- Go - Your payment is securely processed in seconds. Once your payment is confirmed, you're good to go!

What is an EMV Chip Card and how does it work?

EMV chip cards are debit cards with an extra layer of protection, a computer chip, which securely stores the card data that currently resides on the magnetic strip. This makes it nearly impossible to create a counterfeit EMV chip card. The computer chip enables more secure processing by producing a one-time code, or cryptogram, for each transaction. Because EMV chip cards use cryptograms that are unique to each transaction, stolen chip card data cannot be used to create a counterfeit card. The added layer of security provided makes card data much less valuable, decreasing incentive for fraudsters to steal data.

How do I use an EMV chip card?

- Insert Card - Instead of swiping, you'll insert the card into the terminal, chip first, face up.

- Leave the Card in the Terminal - The card must remain in the terminal during the transaction.

- Sign or Enter your PIN - Either sign the receipt or enter your PIN to complete the transaction.

- Remove Your Card - When the purchase is complete, remember to take your card with you.

Which type card do I have?

Both Contactless and EMV chip cards have gold colored chips visible on the front left portion of the card. Contactless cards, however, are distinguished with a symbol on the back with four curved lines resembling radio waves.

As EMV chip cards are expiring, they're being reissued with Contactless cards. If you'd like a Contactless card before then, just stop by one of our lobby locations.

And remember, the Contactless and EMV chip cards still have a magnetic strip, just in case you need to use it with a traditional terminal.

Mobile Deposit

How should I endorse checked deposited with Mobile Deposit?

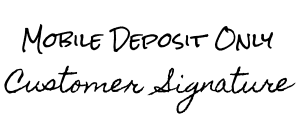

When you are going to deposit a check using Mobile Deposit, use the restrictive endorsement "Mobile Deposit Only" along with your signature. Like this-

How secure is Mobile Deposit?

Very secure. It’s only accessible through your Mobile Banking app and the check images are stored at the bank, not on your phone.

When will my funds be available?

Deposits are available within minutes of being accepted.

What should I do with a check after I've deposited it?

We suggest you write "Deposited" across the front, to remind you it has been submitted. You should hold onto it for at least 14 days, in case the original is needed for some reason. Then you can destroy it.

What are the fees?

McClain Bank does not charge a fee for our Mobile Banking, Mobile Deposit, or Mobile Wallet services. However, your wireless carrier may assess fees for data, text messaging, or web services. Please consult your wireless plan or provider for details.

Online Banking

How do I sign up for Online Banking?

- Online Enrollment – As long as you have an email address on file with us, you may be able to enroll online. We will ask for some additional verification information (account number, social security number, and phone number) so be sure you have that information available before you start the enrollment process. Click here to enroll online.

- Visit one of our Branches – If you’d rather, you may also visit either our Main Bank in Purcell, the Norman Branch, or the Noble Branch and visit with a Customer Service Representative. They will be happy to get you setup and ready to bank online.

What if I forget my Online Banking User ID/Password?

Please call one of our Customer Service Representatives at (405) 527-6503 for any assistance with Online Banking.

Debit Cards

How do I get a McClain Bank Debit card?

Please stop by any of our locations and fill out an application. Our Main Bank in Purcell and the Norman and Noble Branches offer Instant Issue cards, so you can walk out with your new debit card. Otherwise, the card and PIN will be mailed to you within a week or so.

I lost my debit card. What do I need to do?

If your debit card was lost or stolen, please report it immediately. During regular business hours, you can call and talk to a Customer Service Representative at (405) 527-6503. After hours, please call (888) 297-3416. You will also need to determine the last time you used your card in case there is any fraud on it. If so, please call and talk to a Customer Service Representative.

I've forgotten my Debit card PIN? How do I get another?

Please stop by the Main Bank in Purcell or the Norman or Noble Branches and someone in Customer Service will be happy to help you.

I'm traveling out of state/out of country. Will my debit card work?

Happy and safe travels! Your card should work fine but, to be sure, it’s a good idea to call one of our Customer Service Representatives at (405) 527-6503 and talk about debit card usage and find out about any transaction blocks we may have in place. You can add a Travel Notice on your online/mobile banking by going to Card Management and tapping the airplane icon.

How do I report fraudulent activity on my debit card?

First we need to make sure no further activity can occur by cancelling the card. During regular business hours, you can call and talk to a Customer Service Representative at (405) 527-6503. After hours, please call (888) 297-3416. Once you’ve determined what transactions are fraudulent, please stop by the Main Bank in Purcell or the Norman or Noble Branch and talk to a Customer Service Representative.

I just got an email/text message/phone call about my debit card. Is that legitimate?

We do utilize several different systems to review each card transaction processed through the Bank. If we see something that appears suspicious, we may add the card to a watch list, attempt to verify the card activity, or temporarily suspend the card to prevent further activity. If a Fraud Analyst does happen to call you, they will always identify themselves as calling on behalf of McClain Bank and they will NEVER ask for your card number, expiration date, etc. If you have any questions, feel free to call and talk to one of our Customer Service Representatives at (405) 527-6503.

My debit card was just denied. What's wrong?

To better protect you and the Bank, we occasionally create card transaction "blocks" to restrict certain card transactions. We recognize it can be extremely frustrating when your debit card doesn't work, but know that we do everything possible to minimize any impact to your day-to-day activities. Please call one of our Customer Service Representatives at (405) 527-6503 to find out about debit card usage and any transaction blocks we may have in place.

General

What is the routing/transit number for McClain Bank?

Our routing number is 103111618.

Do I have to come into the Bank to open an account?

Yes. One of our Customer Service Representatives at the Main Bank in Purcell or the Norman or Noble branches will be glad to help you. View our location information.

What do I need to open an account?

You’ll need two types of identification (ex. Driver’s License, Passport, Insurance card) and the appropriate opening deposit, depending on the type of account. For more detailed information, please call one of our Customer Service Representatives at (405) 527-6503.

Can I apply for a loan online?

Not at this time. Visit our Forms Library and print out needed forms in preparation for meeting with a Loan Officer in person.

Does McClain Bank offer Mortgage loans?

Yes, we offer a variety of programs and finance options for home purchase and refinance. Visit our Forms Library for printable loan applications and other loan forms. You can call and talk to one of our Mortgage Originators at (405) 447-7283.

How do I change my address?

You can change your address one of three ways -

- Online Banking:

- Login to Online Banking

- Click on the Options tab

- Enter the updated address information

- Click Submit

- In Person - Visit one of our locations and visit with a Customer Service Representative.

- Mail - Download a Change of Address form. Complete it and mail to McClain Bank, PO Box 351, Purcell, OK 73080. Please Note - Forms mailed in must be notarized.

How do I stop payment on a check?

Please call us at (405) 527-6503 or stop by the Main Bank in Purcell or the Norman or Noble branches.

Does McClain Bank offer Mobile Banking?

Yes, we do and we love it! For more information, visit our Online & Mobile Banking page.

How do I order checks?

Ordering checks is easy. If you have any questions or need further assistance, please call Customer Service at (405) 527-6503.

When do checks/deposits post to my account?

Items post to accounts throughout the day. Therefore, we suggest utilizing our 24/7 Telephone Banking or Online & Mobile Banking.

Does McClain Bank offer eStatements?

Yes we do! To enroll in eStatements, log in to online or mobile banking, select an appropriate account, then click Documents. The Enrollment screen will popup. All eligible accounts are selected as default. Verify your email address. Then scroll down, click Agree to Terms, and click Enroll Now. You'll receive a confirmation email, no action is required.

The system will then generate up to 18 months of statement history. Available documents will be listed under the eStatements/Notices tab. At the top you’ll also find options to signup/change available accounts, change email settings, and add/change additional recipients.

I need all of my statements from last year reprinted.

Please call and talk to a Customer Service at (405) 527-6503. Research fees may apply.

How do I send a wire transfer?

Please call us at (405) 527-6503 or stop by the Main Bank in Purcell or the Norman or Noble Branch and talk to someone in the Wire Department.

How do I receive a wire transfer?

Incoming wire transfers need to be sent as follows:

- Bankers Bank, Oklahoma City, OK – ABA 103003616,

-

For Further Credit to McClain Bank – Account number 11161,

-

For Final Credit of Account Number (Your Account Number) In the Name of (Your Name).

If you have any questions, please call and talk to someone in the Wire Department at (405) 527-6503.